25 June, 2019

The Securities and Futures Commission (the “SFC”) has put out a circular to intermediaries conducting prime services and related equity derivatives activities, accompanied by a report on the thematic review which the SFC carried out on the topic, with an annex (the “Annex”) which provides a summary of the standards of conduct and internal controls the SFC expects in this area. The documents highlight some key recurring SFC themes of wider application, as well some specific points which prime brokers (“PBs”) should look at.

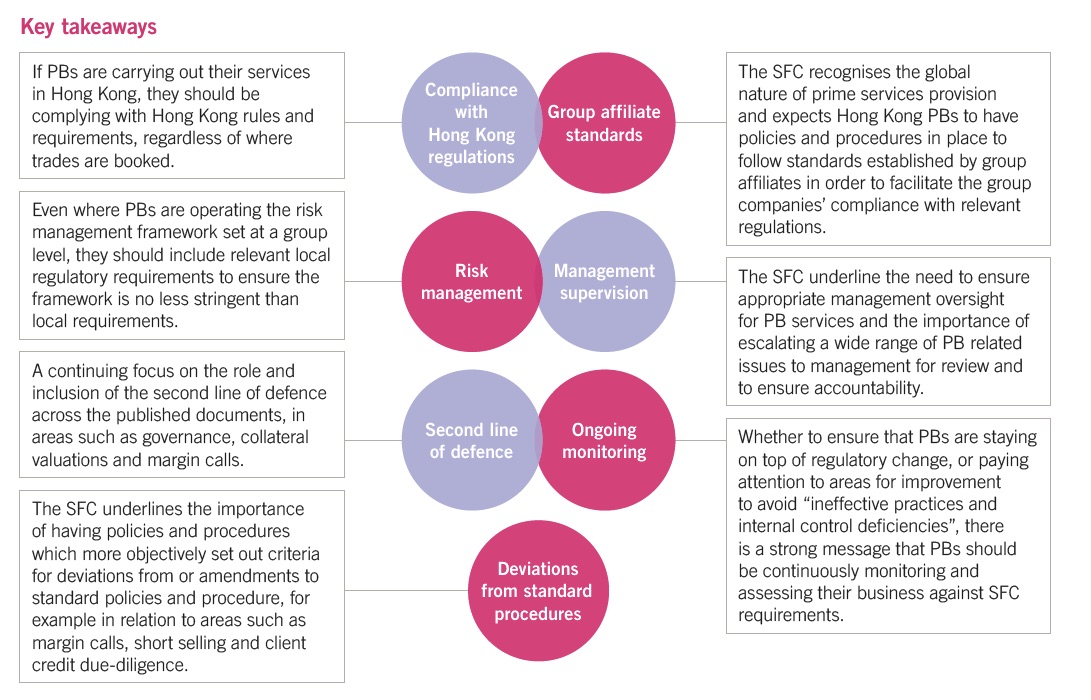

Please click on the image to enlarge.

Background

There has been a steep growth of hedge funds’ assets under management over the last ten years in Hong Kong, and the SFC believes this increase means that prime brokers play an increasingly significant role in the Hong Kong financial markets. The SFC therefore started a thematic review of prime brokers in October 2017 to assess practices, controls and risk management processes. The thematic review consisted of questionnaires and follow up prudential visits across a number of financial institutions in Hong Kong which provide prime services. The findings arising from the thematic review have resulted in the circular and the Annex setting out reminders of and expectations for PBs’ standards of conduct and internal controls.

SFC Verdict

The SFC recognises that PB client relationships involve services provided through various group entities in multiple jurisdictions, and often result in complex operating models. The circular notes that Hong Kong is often the Asia hub for the provision of these global PB service offerings and breaks down the responsibilities for Hong Kong PBs as covering six areas. We highlight some of the SFC’s observations and expectations in each of these areas below.

|

Governance and Management Supervision |

||||||

|

Effective oversight and governance of PB services must be implemented and continuously ensured, with procedures to allow for escalating matters to senior management for review. PBs are expected to comply with Hong Kong rules and regulations, regardless of where risk positions are booked…

However, in recognition of the importance of Hong Kong as an Asia hub within larger groups, the SFC recognise the need for PBs to also have controls and procedures in place to ensure compliance with standards and requirements to be applied on a group wide basis.

The SFC findings show that in practice there is usually a manager in charge with responsibility for oversight of PB services, or at least oversight over the wider area in which PB services sit.

Governance committees should have clearly demarcated responsibilities and terms of reference to ensure the structure, purpose and operation of each committee are clear.

PBs should employ a second line of defence for oversight and management of the risks and controlling key processes.

There should be formalised governance procedures in place with continuous monitoring for identifying and managing or eliminating conflicts of interest.

In addition, there should be staff training in identifying conflicts of interest, and controls to detect conflicts, rather than solely relying on post-conflict escalation.

|

||||||

|

Client Life Cycle Management |

||||||

|

Paragraph 2.1 of the Annex reminds PBs that they must establish the true and full identity of their clients, their creditworthiness and overall risk profile.

Establishing the true and full identity requires a deep dive into structure, governance, risk management, investment expertise with more detail provided in paragraph 2.1 of the Annex than in paragraph 5.1 (Know your client: in general) of the SFC’s Code of Conduct for Licensed Persons. The SFC finds good practices amongst the in-depth investigation into potential clients seen in the thematic review and highlights requiring updated information to be provided during lengthy application processes as a good practice.

Clients serviced from Hong Kong must be subject to Hong Kong anti-money laundering/counter terrorist financing CDD, even if the clients have been onboarded using contracts with overseas affiliates.

PBs should carry out ongoing assessments of clients (including creditworthiness, risk and so on), for example on an annual basis, and any ad-hoc reviews, such as an event driven review, should not generally push back the standard periodic reviews in place.

|

||||||

|

Margin Financing |

||||||

|

In recognition of the multi-jurisdictional practices involved in providing credit to clients, PBs should have guidelines in place, along with controls and procedures, to follow group-wide margin financing standards and the relevant rules and regulations.

Clear and well documented controls and procedures must be in place for the provision of margin financing, including monitoring margin terms are appropriate, enforcing or waiving margin calls and the use of manual price overrides.

Criteria for deviations from policies should be clearly set out and be approved independently or by management, as well as being documented.

|

For further information, please contact:

Annabella Fu van Bijnen, Partner, Linklaters

annabella.fu@linklaters.com